According to a recent Merril Lynch (Bank of America) survey, Europe has officially returned to favor among investors. “A net 30% of global portfolio managers see euro-zone equities as undervalued relative to other regions, the highest reading since April 2001. A net 11% are overweight Europe, the first overweight allocation in nearly two years, said Baker.” The numbers, meanwhile, reflect this perception. Over the last month, investors have poured a net (inflows minus outflows) $2.1 Billion into EU capital markets, an impressive sum when you consider that the figures for Japan and the US were both negative. Meanwhile, stock markets in the region are up by 50%+ since bottoming last March. When you account for currency fluctuations (i.e. Euro appreciation), stock market comparisons between the US and EU start to look pretty lopsided. According to a WSJ report, there’s no mystery behind the European stock market rally: “Even though prices have risen sharply since March, valuations aren’t stretched. Average price-to-earnings ratios in Europe, on a trailing 12-month basis, are about 16, up from seven back in March, according to Citigroup…On a price-to-book ratio, stocks are trading about 15% below their long-term average, and dividend yields compared to government bond yields are historically still very attractive.”

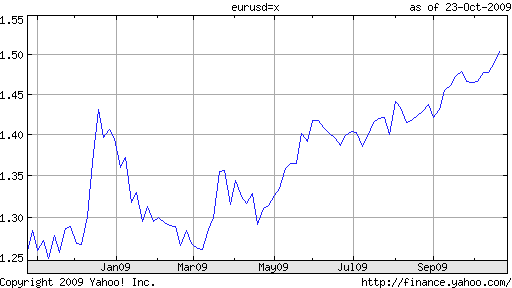

At this point, you’re probably wondering, “Why the long preamble on European stocks?” Because, it’s easy to forget that there are inherently two sides to every currency pair. In the case of the USD/EUR (the most frequently traded pair in the world), most of the recent commentary has focused exclusively on Dollar-negatives, portraying the dynamic as a depreciation in the Dollar. In this context, it’s easy to forget that the Dollar’s depreciation implies an appreciation in the Euro. Duh?! But seriously, for every Dollar bear, it seems there is at least one Euro bull. To be fair, those who don’t see much to be excited about in the Euro can be forgiven. After all, the European economy is technically still mired in recession, and isn’t projected to return to growth until 2011. While some of the intangible indicators are improving, others continue to stagnate. “Industrial output in the euro zone is 20% lower than its February 2008 peak, despite some recent improvements.” In addition, the appreciation in the Euro threatens to choke off exports and stifle the recovery before it has a chance to get off the ground. Speaking of which, the European Central Bank (ECB) will probably hold of on raising rates because of the strong currency. A more valuable Euro keeps inflation in check (via cheap imports). Besides, higher interest rates would attract carry traders hungry for yield, and would make it even more difficult to keep the Euro in check. Many EU monetary officials (including ECB President Jean-Claude Trichet) have already made their concerns about the Euro’s appreciation clear. If they are able to succed in halting its rise, that could make investing in Europe a lot less exciting…

|

No comments:

Post a Comment